The combination of finance and technology has introduced many innovative offerings, starting from ATMs and credit cards to digital banking. Over the years, fintech has expanded into a massive industry, with prominent fintech trends gaining momentous acceleration in the domain of technology.

How is the fintech industry prepared for 2023? Some reports suggest that the market capitalization of the fintech industry could reach almost $174 billion in 2023. On top of it, the use cases of fintech have been serving diverse value benefits in different sectors for consumers as well as businesses.

The notable use cases in fintech include cryptocurrencies, insurance technology, and mobile banking and investment apps. However, the consistently changing landscape of fintech requires businesses and consumers to stay updated with the latest trends in fintech. The following post offers you insights into the top trends in fintech you must watch out for in 2023.

Want to become familiar with Fintech and its working? Become a member and Enroll Now in Fintech Fundamentals Course!

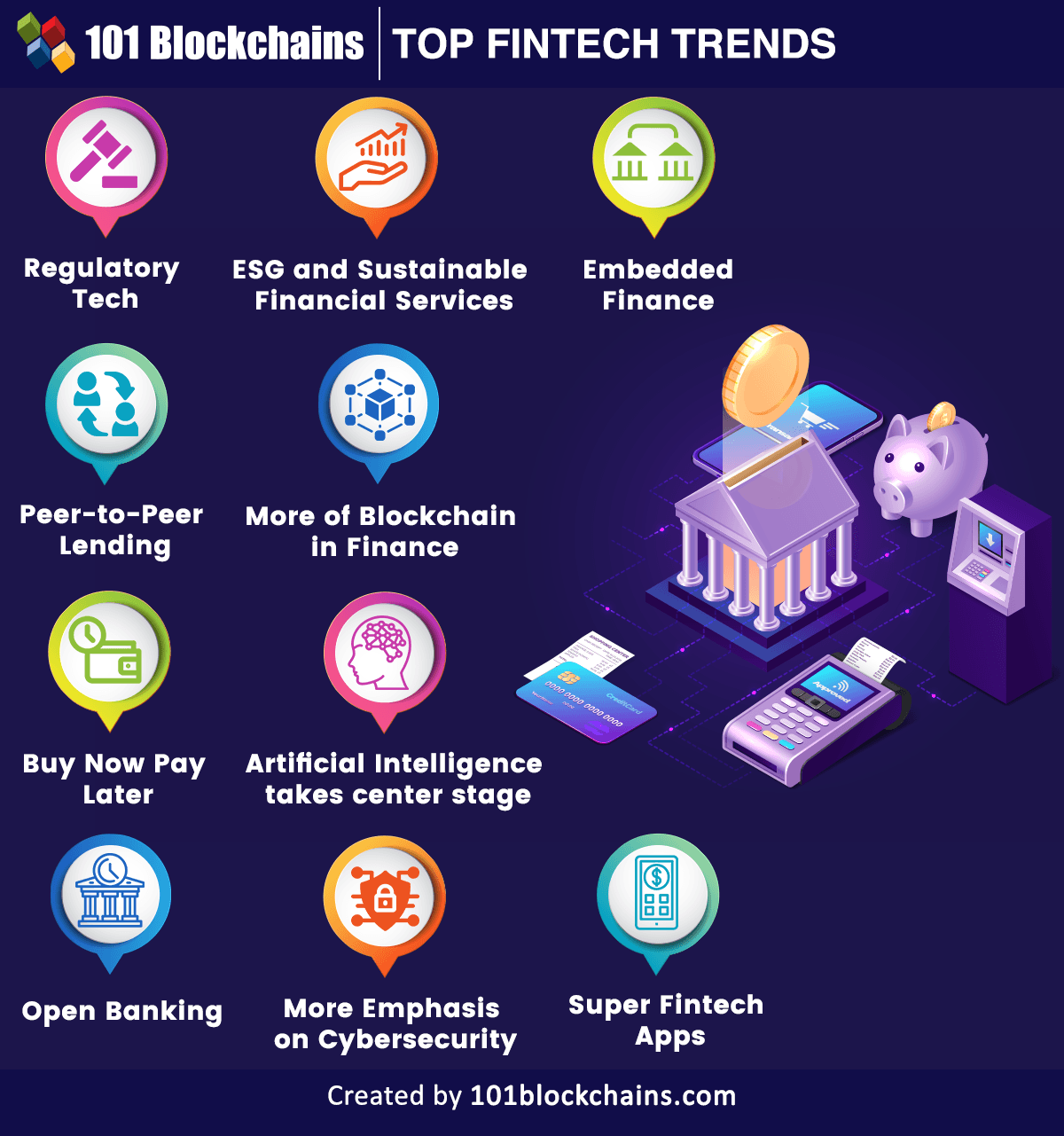

Top Fintech Trends for 2023

The review of trends in fintech is an essential requirement for coming up with viable strategies to cope with new changes in the market. Fintech focuses on improving the efficiency of financial services and processes, and fintech industry trends in 2023 would speed up the journey towards the goal. Digital transformation established the stage for innovation in the financial services sector, with an emphasis on optimizing customer success metrics.

For example, decentralized finance and peer-to-peer lending are some of the revolutionary outcomes of innovation in fintech. However, fintech funding declined to almost $12.9 billion in 2022, and cryptocurrencies have been having a tough time on the market. Therefore, new startups and users need updates on the important trends in fintech to navigate the highs and lows of the domain. Here are some of the top trends which would shape the face of fintech in 2023.

Want to learn and understand the scope and purpose of DeFi? Enroll Now in Introduction to DeFi- Decentralized Finance Course

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://council.101blockchains.com/wp-content/uploads/2023/04/Top-FinTech-Trends.png' alt='Top FinTech Trends='0' /> </a>

1. Regulatory Tech

Regulatory Tech, or RegTech, is one of the most noticeable trends in the domain of fintech. As the adoption of fintech gains momentum, regulators would tighten the approaches for scrutiny of fintech companies. The answers to “What are the current fintech trends?” reflect on the necessity for fintech companies to focus on compliance.

RegTech can offer credible solutions for leveraging technology to ensure compliance with the required rules and regulations. It can provide the value benefits of automation in ensuring compliance. Most important of all, RegTech utilizes cloud technology, data analytics, and machine learning development, which would become prominent highlights in 2023.

Companies in the domain of financial services can utilize RegTech to navigate the requirements of compliance. The use cases of RegTech revolve around the identification of potential legal risks, which can ensure the safe and efficient operations of companies.

In addition, it can also contribute to streamlining organizational operations. You can adopt such latest fintech trends by reflecting on important factors such as the assessment of regulatory requirements. In addition, factors such as flexibility of integration with existing processes and systems can ensure limited disruptions and lower costs.

Aspiring to make a lucrative career as a Fintech expert but not sure how? Check the detailed guide Now on How To Become A Fintech Expert

2. ESG and Sustainable Financial Services

The sensitivity towards environmental issues and climate change has escalated significantly following the COVID-19 pandemic. Another top addition among fintech trends in 2023 is the drive towards achieving ESG goals and green financing. Many nations worldwide have expressed their commitment to addressing sustainability goals.

Now, ESG and green financing have emerged as crucial areas in fintech for companies, investors, and customers. Therefore, the demand for definition, evaluation, and reporting of ESG metrics would emerge as a crucial priority for fintech companies. Fintech companies which showcase commitment to environment-friendly values are likely to attract customers.

One of the prominent examples of ESG goals as one of the top fintech trends is the growth of sustainable investment strategies. Many financial institutions, such as insurance providers and banks, have come up with innovative portfolio options. The loans and ESG bonds related to environmental projects are promising examples of ESG objectives.

At the same time, fintech companies have to look for sustainable financing options which align with environmentally sustainable results. Sustainable financing would most likely drive the success of the private sector in sustainability efforts, alongside encouraging collaboration between the public sector and the private sector for financing mechanisms.

Eager to know about important skills you need to become a fintech professional? Check the detailed guide now on The Most In-Demand Skills For Fintech

3. More Blockchain in Finance

The year 2023 will also witness the rising adoption of blockchain in fintech. You can find innovative use cases of blockchain in fintech with significant value advantages. Blockchain is one of the notable fintech trends as it can disrupt different industries with the benefits of transparency, security, and efficiency. Gartner has predicted that blockchain would generate a business value of almost $3.1 trillion by 2030. In 2023, the C-suite adoption of blockchain use cases is likely to accelerate further.

The prominent highlights in favor of blockchain applications in finance include cryptocurrencies and smart contracts. Cryptocurrencies are gradually becoming one of the powerful financial instruments with formidable influence on the domain of financial technology.

Smart contracts have emerged as a reliable solution for value-based applications of automation in the domain of fintech. The fintech industry trends related to blockchain also refer to the use of smart contracts for creating DeFi solutions. Furthermore, blockchain solutions would set the stage for mainstream adoption with the power of advanced smart contracts.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

4. Embedded Finance

Another noticeable highlight in the fintech industry in 2023 would be embedded finance. It is one of the most promising trends in the domain of fintech as it focuses on the integration of financial services in non-financial applications and websites. Embedded finance qualifies as one of the top fintech trends focused on ensuring convenience for customers. With the applications of embedded finance, consumers don’t have to visit the bank or go through complex paperwork to get a loan. On top of it, embedded finance ensures that customers can access financial services directly on the platform or app they use.

The most promising advantage of embedded finance is the freedom from having to re-enter payment information and credentials for every purchase. As a result, customers can have an efficient and secure shopping experience with embedded finance. For example, the flexibility for making payments through digital wallets shows how embedded finance can improve convenience in accessing financial services. E-commerce merchants are likely to turn towards embedded finance to improve user experiences.

Curious to know different categories of interview questions for fintech jobs? Check the detailed guide Now on Top 20 Fintech Interview Questions And Answers

5. Peer-to-Peer Lending

The outline of popular trends in fintech would remain incomplete without mentioning peer-to-peer lending. It is one of the most popular approaches for lending, which has gained significant momentum recently in the domain of alternative finance. Discussions around “What are the current fintech trends?” point to the efficiency of P2P lending as an alternative lending mechanism. The most distinctive highlight of peer-to-peer lending is the direct connection between lenders and borrowers through an online platform.

The advantages of peer-to-peer lending point to the elimination of traditional intermediaries such as banks for cost reduction. It can offer better cost-effective solutions for lending. Peer-to-peer lending can serve consumer markets as well as business markets and has grown into a mainstream form of financing. Fintech startups would look for opportunities to capitalize on the benefits of cost-effective, secure, and flexible financing options.

Curious to know about the fintech terms and phrases in detail? Read the detailed guide Now on Ultimate FinTech Glossary For Beginners

6. Artificial Intelligence takes center stage

Artificial intelligence, or AI, is one of the fastest-growing technologies and has the potential to influence the fintech sector. Financial institutions can identify popular fintech trends 2023 in the different innovative ways for leveraging AI. One of the most common examples of AI in the world of fintech is the use of chatbots, which improve customer experience. The other significant value advantage of AI in the world of fintech refers to data analytics. Growing adoption of fintech solutions would increase the amount of financial data generated across different transactions.

AI can help in identifying suspicious activity patterns and discrepancies for detecting security threats from massive volumes of unstructured data. Robotic Process Automation can also help in harnessing the power of artificial intelligence for the automation of middle-office tasks.

Want to explore an in-depth understanding of security threats in DeFi projects? Become a member and get free access to DeFi Security Fundamentals Course Now!

7. Buy Now Pay Later

Buy Now Pay Later, or BNPL is also another noticeable trend in fintech which can gain momentum in 2023. It refers to a short-term financing option that can help in delaying the payment for products or services to a later date. What is the advantage of BNPL over traditional financing?

The answer points to the availability of BNPL financing without interest, thereby serving as a viable option for many borrowers. The rise of the latest fintech trends with BNPL financing enables point-of-sale installment loans, where customers can pay a certain portion of the payment during purchase and pay the remaining amount later.

Buy Now Pay Later has garnered significant popularity for reasons such as an easier approval process, flexibility, and lower interest rates. Fintech companies would have to find strategic approaches for leveraging BNPL as a popular trend in financial technology applications.

Want to explore in-depth about DeFi protocol and its use cases too? Become a member and get free access to Decentralized Finance (Defi) Course- Intermediate Level Now!

8. More Emphasis on Cybersecurity

Security threats in the domain of fintech invite the need for more attention to cybersecurity in 2023. The continuously evolving threats in cybersecurity, complemented by their rising sophistication, have created massive issues for the financial services sector. Companies have to take note of the top fintech trends in cybersecurity, such as behavioral analytics, biometric authentication, and AI-based fraud prevention.

Fintech companies have to find new and effective ways to safeguard their systems from unwarranted attacks and ensure the safety of customer data. Investments in blockchain technology might gain momentum for addressing the security concerns in fintech.

9. Open Banking

The domination of open banking in fintech will be more clearly evident in 2023. Open banking is one of the prominent additions among fintech trends that leverage the background of digital transformation. Customers can use open banking to access financial data from different service providers through secure apps and solutions.

Open banking standards and services have enabled the flexibility for fintech enterprises to work for sharing information with different financial institutions. Open banking can provide a strong foundation for collaboration between banks and fintech companies with a secure environment.

Start learning Decentralized Finance (DeFi) with World’s first DeFi Skill Path with quality resources tailored by industry experts Now!

10. Super Fintech Apps

The growth of alternative financing fuels the debates around “What are the current fintech trends?” by presenting valuable use cases. Super fintech apps or super apps would serve as a gateway for accessing multiple services, including banking, transportation, food delivery, and shopping. Alternative financing and super apps would most likely establish a strong command over the future of fintech as alternative finance gains popularity. Furthermore, super apps can also gain popularity with the expansion of financial services in their portfolio.

We have an insightful webinar session for DeFi And The Future Of Finance too. Become a member now to watch our on-demand webinar on DeFi And The Future Of Finance

Conclusion

The review of the top fintech trends which would shape the fintech space in 2023 shows that user experience will be a top priority. Fintech is still in the initial stages of development, and it inches closer to mainstream adoption with every passing day. However, every good thing takes time, and innovation in fintech has proved the same with productive use cases. Startups interested in adopting fintech should look for the top trends which can help them adapt to the changes in the industry. Learn more about fintech fundamentals and how to capitalize on the top trends in fintech for 2023 right now.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!