DeFi has emerged as the new alternative to traditional finance systems. With the help of the security of blockchain technology, the applications of DeFi could help in removing intermediaries such as banks, brokerages, and exchanges for conducting financial transactions. Therefore, the DeFi finance interplay is a significant highlight for the future. The DeFi infrastructure and regulations are still in the initial stages and subject to debate, albeit attractive to customers.

The DeFi system enables users to assume control and overcome the unwanted control and authority exercised by central intermediaries. What does DeFi mean in general for the future of finance? You can find an answer by reflecting on the basics of DeFi and its benefits. The following discussion helps you learn about these aspects, alongside diving deeper into potential estimates for the future state of decentralized finance.

Join Our Annual Membership and become a Featured Member now!

Defining DeFi

The financial technology industry is growing at massively exponential rates. As of March 2022, DeFi has almost over $83 billion in TVL or total value locked across different smart contracts. Therefore, the discussions equating DeFi and the future of finance have been gaining momentum in recent times. First of all, you need to learn about the definition of DeFi before you identify its impact on the future of finance.

DeFi, or decentralized finance, is a revised perspective on technology for recreating financial services through blockchain technology. The primary technologies underlying DeFi refer to Ethereum and smart contracts. Just like conventional banking, DeFi can help users in carrying out traditional financial transactions like transfers, savings accounts, investing, or lending.

The definition of DeFi would focus profoundly on allowing access to financial services without the involvement of intermediaries. It is important to note that the future of DeFi would focus largely on removing the intermediary entity and ensuring decentralization. You would not find any brokerage, financial institutions, or exchanges within the DeFi ecosystem. As a result, a DeFi application could easily move over the conventional barriers and reach out to various markets, regions, and multiple layers within society.

Want to learn and understand the scope and purpose of DeFi? Enroll Now in Introduction to DeFi- Decentralized Finance Course

Working of DeFi

A detailed understanding of how DeFi works is essential for identifying its role in shaping the future. One of the primary objectives of DeFi refers to the use of decentralized technology for facilitating financial services to businesses and customers. The future of decentralized finance would depend profoundly on the improvement of the decentralization aspect in enabling access to financial services. Basically, DeFi provides new infrastructure for delivering loans, payments, savings, and interest-earning facilities without changing the type of services. The big change with DeFi is evident in the approach followed for delivering the services.

From a general perspective, you can find answers to “Is DeFi the future of finance?” by exploring a simple explanation of the working of DeFi. Decentralized finance, or DeFi, depends on blockchain technology and smart contracts for primary functionalities. Blockchain, the decentralized ledger, provides the foundation for conducting and storing transactions over a peer-to-peer network.

Blockchain has been largely popular in the domain of cryptocurrencies, thereby proving their relevance for financial services. Another important aspect you must keep in mind refers to the documentation of transactions in blocks followed by verification by other users. When verifiers can reach a consensus regarding the validity of transactions, the block must be closed alongside being encrypted.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

Existing State of DeFi

The best approach for learning about the future of finance with decentralization would involve a comprehensive overview of the existing performance of DeFi. Interestingly, the figures for DeFi have been largely favorable for growing the interest of investors and users in decentralized finance. As of April 2022, the total value of crypto assets locked across different DeFi platforms amounted to more than $210 billion. The estimated market capitalization for Ethereum-based DeFi projects amounted to almost $116 billion. Forbes had estimated the market capitalization of DeFi in 2021 at almost $74.8 billion.

Decentralized finance has also registered some promising potential for achieving explosive growth in the upcoming decade. One of the prominent examples of a better future of DeFi would refer to MakerDAO, which has garnered almost $6 billion in investments. The potential of DeFi for changing conventional financial instruments delivers conclusive proof regarding its capability to change the future of the financial services industry. Interestingly, the transactions on the Ethereum blockchain amounted to almost $11.6 trillion in 2021. Therefore, you can notice how decentralized finance is already a dominant force in the world of finance.

Excited to learn the basic and advanced concepts of ethereum technology? Enroll Now in The Complete Ethereum Technology Course

Popular Examples of DeFi Applications

The DeFi finance interplay can become stronger with the implications of programmability. Decentralized finance relies on cryptocurrencies and smart contracts for facilitating financial services without involving banks. Adding more decentralized apps presents different perspectives on the role of DeFi in transforming finance. New apps can help in introducing new possibilities with DeFi, as popular examples of Aave, Uniswap and Compound have proved the credibility of decentralized finance.

Popular examples of decentralized finance would include faster payments, storage of money in crypto wallets or lending and borrowing services. In addition, DeFi could help in trading tokenized variants of investments like funds, securities, stocks and other financial assets. Most important of all, DeFi also includes NFTs in its scope alongside other new services such as crowdfunding and insurance.

Aspiring to Become a Certified NFT Expert? Enroll in Certified NFT Professional (CNFTP) Course Now!

Advantages of DeFi

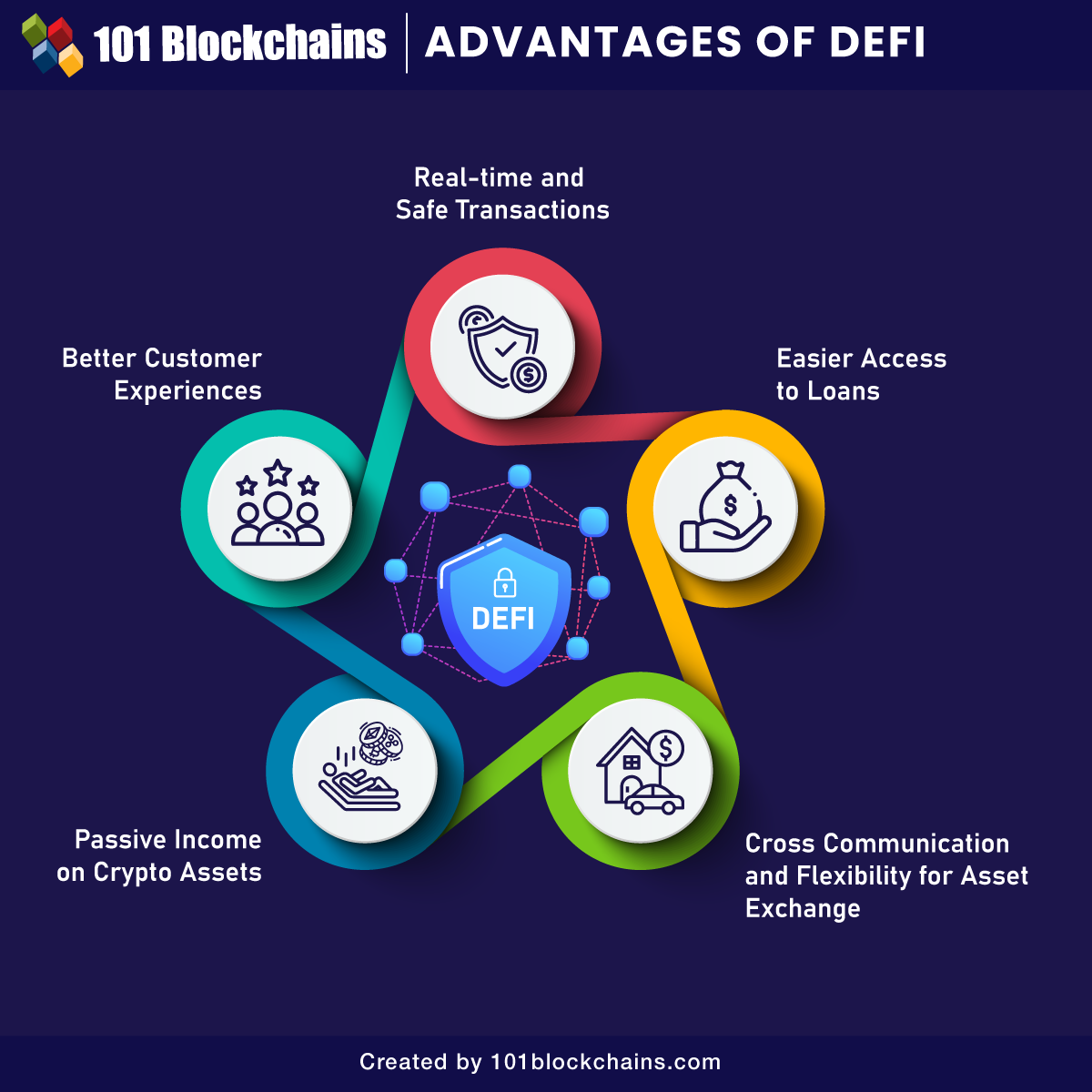

The discussions which connect DeFi and the future of finance would also focus on the benefits of DeFi. Decentralized finance ventures have successfully grabbed the attention of many popular backers. Most important of all, the optimism around the capabilities of DeFi for transforming the conventional financial landscape is also a favorable highlight for the growth of decentralized finance. However, the future of decentralized finance would depend considerably on the advantages it introduces in the domain of finance.

For starters, you have the advantage of pragmatic use cases of DeFi in different aspects, such as stablecoins, savings, lending and borrowing, tokenization, insurance, and decentralized exchanges. One of the biggest highlights about DeFi, which would carry it forward, refers to the freedom from conventional services. In addition, DeFi can ensure the facility of following crucial value advantages in finance.

-

Real-time and Safe Transactions

The biggest highlight in decentralized finance would point to the advantage of almost real-time and secure transactions. DeFi offers a transparent and considerably secure payment solution, which enables the decentralization of services alongside improving the security of investor assets. You can complete payments across platforms of your choice.

Want to learn the fundamentals of tokenization? Enroll Now in Tokenization Fundamentals Course

-

Easier Access to Loans

The answers to “Is DeFi the future of finance?” can also find some clarity in the facility of easier access to lending and borrowing applications. DeFi networks have been successful in streamlining the lending and borrowing process. How many of you have tried applying for a loan in a bank? Credit score checks and the need for fixed asset collateral in traditional loans affect the effectiveness of the whole process. On the other hand, DeFi enables borrowers to take loans directly from lenders without any intermediaries.

-

Cross Communication and Flexibility for Asset Exchange

The scope of interoperability in traditional finance is limited by many factors. On the contrary, DeFi can ensure desired interoperability among blockchains as well as the traditional and decentralized finance worlds. Many examples have proved how decentralization can enter the fiat systems, such as the platforms supporting peer-to-peer payment facilities. In addition, the example of NFTs transforming the conventional payment systems implemented in the music industry also suggests how DeFi has grown in recent years.

Want to learn blockchain technology in detail? Enroll Now in Certified Enterprise Blockchain Professional (CEBP) Course

-

Passive Income on Crypto Assets

The impact of DeFi on the future of finance is also evident in the facilities for obtaining passive income from crypto assets. Decentralized finance serves multiple options such as yield farming, liquidity mining, or staking for reaping favorable returns on crypto assets. Furthermore, DeFi has also been opening up the gates to opportunities, like play-to-earn games, for better chances of earning passive income.

-

Better Customer Experiences

The role of DeFi in fuelling the future of financial services would also focus on new priorities for customer experiences. What role does customer service play in the existing financial landscape? What are the privileges which a customer enjoys in traditional financial services? These questions can help you reflect on the necessity for a DeFi finance revolution. Banks cannot stay open for you throughout the day. On the other hand, online financial services put your sensitive personal information at risk. Therefore, DeFi works as a trusted solution for revising customer experiences with financial services.

Setbacks for DeFi

The overview of prospects for the future of DeFi would also account for the setbacks for DeFi. Regardless of the optimism around DeFi, it is still in the initial stages of development. For example, many people have pointed out possibilities of money laundering and criminal activities behind the anonymity of users.

Most important of all, regulators have not achieved favorable clarity regarding the resolution of potential issues with DeFi usage. How are DeFi platforms prepared to address the volatility risks with cryptocurrencies? Investors need detailed and transparent insights regarding yield-generation schemes with the DeFi market.

Want to become a Cryptocurrency expert? Glad to announce that we are launching Cryptocurrency Fundamentals Course soon!

Final Words

The popularity of decentralized finance or DeFi is the only factor that calls for discussions about its future. In addition, the evolution of new types of DeFi apps also calls for reflecting on new possibilities with decentralized finance. The association between DeFi and the future of finance would help you understand how the benefits of DeFi improve value.

At the same time, you need to take the setbacks of DeFi into consideration before painting a favorable picture. For example, you don’t have a fixed regulatory landscape for the domain of DeFi. Therefore, it is difficult to estimate the regulatory risks in the initial stages of the DeFi landscape. Explore the best possible solutions for making the most of DeFi now.

Join our annual/monthly membership program and get unlimited access to 35+ professional courses and 60+ on-demand webinars.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!